As predicted, the fallout from the United States Supreme Court decision in Bittner v. United States, means a tougher stance by the Internal Revenue Service (IRS) when it comes to reducing so-called “FBAR” penalties for “nonwillful” violations. In a nutshell, the Bittner court held that the Bank Secrecy Act (BSA) $10,000 maximum penalty for the nonwillful “violation” of FBAR reporting (Form 114) applies on a per report, and NOT (as the IRS would like it) on a per account, basis. In other words, the “violation” under the BSA is the failure to file an annual FBAR regardless of how many foreign accounts were not reported. This results in a single $10,000 penalty for a particular calendar year rather than separate $10,000 violations for each account that was not properly reported on the FBAR. This decision reduced Mr. Bittner’s FBAR penalty from $2.72 million (272 unreported foreign accounts) to $50,000 (5 years of unfiled FBARs). More on the Bittner case at my blog post here.

IRS Hits Back

Unsurprisingly, the IRS took swift action after Bittner. In July, IRS issued a special Guidance Memorandum updating its Internal Revenue Manual (IRM) FBAR examination procedures. The guidance in the Memorandum will be incorporated into the IRM within two years but it is effective as of July 6, 2023.

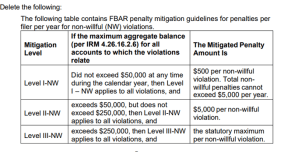

The Memorandum acknowledges that “[e]ach reference to ‘violation’ as used in [the BSA] to refer to a failure to comply with the reporting requirements …should be read to mean: a failure to file an FBAR report…” The Memorandum also eliminates the IRM mitigation provisions for nonwillful FBAR violations and they will no longer be considered in calculating penalties for nonwillful violations. Now mitigation for such violations is left entirely up to the IRS examiner on a case-by-case basis.

The Memorandum instructs that the penalty mitigation chart shall be deleted from the IRM FBAR examination procedures.

In addition, it reminds examiners that there may be multiple FBAR penalties for example, if co-owners are involved or if different persons have signature authority over the account. In such cases, each person is required to file the FBAR and each responsible person can be liable for the full amount of the penalty. In addition, both FBAR reporting and required recordkeeping can result in separate violations for any year. Examiners will now have discretion in determining whether both penalties should apply.

The Memorandum states that the IRM will be revised to provide that “in most cases” involving nonwillful violations, examiners will recommend one $10,000 penalty per nonwillful violation. In no event will the total amount of the penalties for nonwillful violations (among all open years) exceed 50 percent of the highest aggregate balance of all foreign financial accounts to which the violations relate for the years under examination.

Remember, the Bittner decision did not impact “willful” FBAR violations. Penalties for willful reporting violations still apply on a per account basis. The IRM guidance regarding the calculation of willful FBAR penalties has not been changed.

“Reasonable Cause”

Despite the fact that the IRM’s non-willful violation penalty mitigation procedures will no longer apply, FBAR penalties can be averted if the taxpayer meets the “reasonable cause” exception. In examining if this exception can apply, the IRS agent will consider all relevant facts, including the taxpayer’s experience, knowledge, and the extent to which he or she made efforts to comply with the FBAR requirements.

Many persons living abroad are unaware of their FBAR duties, especially the so-called “accidental American”. In addition, many immigrants to the US or international assignees to work in the US are also unaware of the FBAR rules. Sadly too many professionals are still not up to speed about FBAR. When trying to use the reasonable cause exception, it is best to come into compliance prior to any IRS examination.

Fix It!

Taxpayers with FBAR problems can (and should) fix them. A competent tax professional can provide proper guidance and assist in determining if one of the Streamlined Offshore Procedures, or the Delinquent FBAR Procedure can work and avoid all FBAR penalties.

Listen to my podcast with attorney John Richardson on this topic.

Posted August 10, 2023

All the US tax information you need, every week –

Named by Forbes, Top 100 Must-Follow Tax Twitter Accounts @VLJeker

Named by Bloomberg, Tax Professionals to Follow on LinkedIn

Subscribe to Virginia – US Tax Talk to receive my weekly US tax blog posts in your inbox. My blog specializes in foreign and US international tax issues.

You can access my papers on the Social Science Research Network (SSRN) at https://ssrn.com/author=2779920

3 thoughts on “Post-Bittner, IRS Gets Tougher on “Nonwillful” FBAR Penalties ”